What Does Occ Stand for in Banking

About Us

The OCC charters, regulates, and supervises all national banks and federal savings associations as well as federal branches and agencies of foreign banks. The OCC is an independent bureau of the U.S. Department of the Treasury.

About Us

The OCC charters, regulates, and supervises all national banks and federal savings associations as well as federal branches and agencies of foreign banks. The OCC is an independent bureau of the U.S. Department of the Treasury.

About Us

The OCC charters, regulates, and supervises all national banks and federal savings associations as well as federal branches and agencies of foreign banks. The OCC is an independent bureau of the U.S. Department of the Treasury.

Our Mission

To ensure that national banks and federal savings associations operate in a safe and sound manner, provide fair access to financial services, treat customers fairly, and comply with applicable laws and regulations.

Our Vision

The OCC is the preeminent prudential supervisor that

- adds value through proactive and risk-based supervision;

- is sought after as a source of knowledge and expertise; and

- promotes a vibrant and diverse banking system that benefits consumers, communities, businesses, and the U.S. economy.

Our Core Values

The OCC adheres to four key tenets in carrying out its mission and vision:

- Integrity

- Expertise

- Collaboration

- Independence

Who We Are

Our Leadership

The people who lead the OCC are experienced professionals with diverse backgrounds in disciplines necessary to advance the agency's mission and vision. They are experts in bank examination, law, risk management, economics, finance and accounting, organizational management and governance, human resources, communications, and technology. They collaborate to help ensure the safety and soundness of our federal banking system and to help make the OCC one of the best places to work in the federal government.

What We Do

The OCC, an independent branch of the U.S. Department of the Treasury, charters, regulates, and supervises all national banks and federal savings associations as well as federal branches and agencies of foreign banks. The OCC carries out its mission by

- issuing banking rules and regulations and providing legal interpretations and guidance on banks' corporate decisions that govern their practices.

- visiting and examining the banks it oversees.

- evaluating applications for new bank charters or branches; for other proposed changes in the corporate structure of banks or their activities; and from foreign banks that wish to operate in the United States under an OCC charter.

- imposing corrective measures, when necessary, on OCC-governed banks that do not comply with laws and regulations or that otherwise engage in unsafe or unsound practices.

- protecting consumers by making sure banks give fair access and equal treatment to customers and comply with consumer banking laws.

OCC at a Glance

1,125

Banks Supervised

The OCC supervises national banks, federal savings associations, and federal branches and associations of foreign banks.

$14.9T

Value of Bank Assets

These assets, held by OCC-regulated institutions, compose 65 percent of all U.S. commercial banking assets.

2,388

OCC Examiners

OCC examiners are located across 91 operating locations.

$1.095B

FY 2021 Budget

The OCC's operating and capital budget is funded primarily by assessments, fees paid by banks, interest received on investments, and other income.

Our History

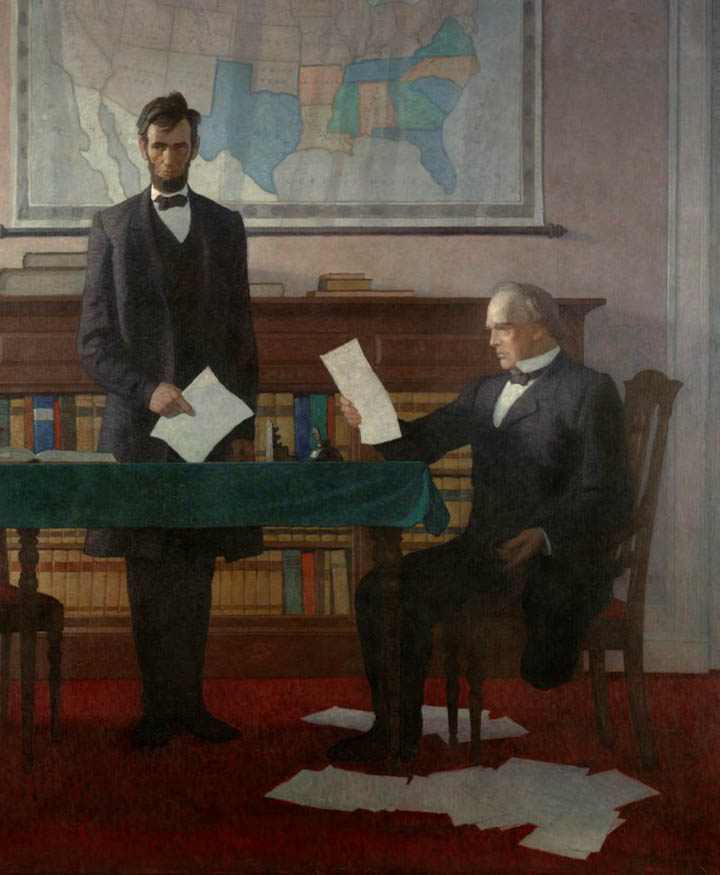

Founding of the OCC and the National Banking System

President Abraham Lincoln recognized that the United States' fragmented banking and monetary system needed tighter structure and order. On February 25, 1863, President Lincoln signed the National Currency Act into law, creating the Office of the Comptroller of the Currency and charging it with responsibility for organizing and administering a system of nationally chartered banks and a uniform national currency.

Hugh McCulloch: The OCC's First Comptroller

President of the Bank of Indiana, Hugh McCulloch had come to Washington to fight against the national banking legislation that had been signed by President Lincoln in February 1863. Ironically, he ultimately became its champion and proved to be an industrious, able administrator as the first Comptroller of the Currency. He went on to serve two terms as Secretary of the Treasury.

President Lincoln with Treasury Secretary Salmon P. Chase

What Does Occ Stand for in Banking

Source: https://www.occ.treas.gov/about/index-about.html